Toyota falters as Japan’s EV hesitancy takes toll in China

Japan’s largest automaker, Toyota Motor, is laying off workers in China as the company struggles to keep up in the world’s biggest EV market.

Toyota lays off workers amid China’s EV transition

Japanese automakers are stumbling in China’s evolving auto landscape. According to a new report from Reuters, Toyota’s joint venture with China’s Guangzhou Automobile Group (GAC) laid off workers this weekend, offering them compensation.

Three workers who were affected said the move comes as the Japanese automaker is struggling in China’s ultra-competitive auto market that’s rapidly transitioning to EVs.

The joint venture’s factory in China employs around 19,000 people, producing models such as Toyota’s first EV, the bZ4X, alongside the Camry and Levin models.

Toyota launched the bZ4X in China in October 2022 with a starting price of 199,800 yuan (around $19,000). However, after several market leaders, including BYD and Tesla, cut prices, Toyota failed to gain traction.

The Japanese automaker sold 3,844 bZ4X models in China through January, representing just 0.26% of China’s EV market.

To boost sales and remain competitive, the automaker slashed prices by 15% in response earlier in February, with a new starting price of around 169,800 yuan ($24,800).

So far, the move has failed to make a difference, with EV sales falling 9% in the first six months of the year.

Despite launching its first electric sedan in China earlier this year, the BYD-powered bZ3 starting at 189,800 yuan ($27,000), Toyota (through FAW-Toyota) is recalling (not OTA) over 12.2K bZ3 electric sedans over defective rear door handles.

After taking over for longtime leader and grandson to the company’s founder (Akio Toyoda) in April, former Lexus branding chief officer Koji Sato said Toyota would need to act urgently to keep up in China’s EV market.

After seeing the impact of EVs at the Shanghai Auto Show, Sato explained:

We need to increase our speed and efforts to firmly meet the customer expectations in the Chinese market.

Meanwhile, Toyota is not the only Japanese automaker suffering in China amid the country’s shift to EVs.

China’s EV market takes a toll on Japanese automakers

According to the China Association of Automobile Association, Japanese automakers’ market share in the region has fallen from 20% last year to 14.9% in the first half of 2023.

Electric vehicle sales in China reached over 2 million through the first five months of the year, up 51.5% YOY as buyers continue adopting EVs at a record pace.

Japanese automakers, who have been arguably the biggest laggards in the EV market, are feeling the pinch the most.

For example, Mitsubishi Motors revealed in a memo last week it was suspending operations in China indefinitely after sales fell drastically. The memo (via Bloomberg) stated:

In the past few months, management and shareholders have tried to the best of our ability, but due to market conditions and with great reluctance and regret, we must seize the opportunity to transition to new energy vehicles. The company will resurrect after going through trials and tribulations.

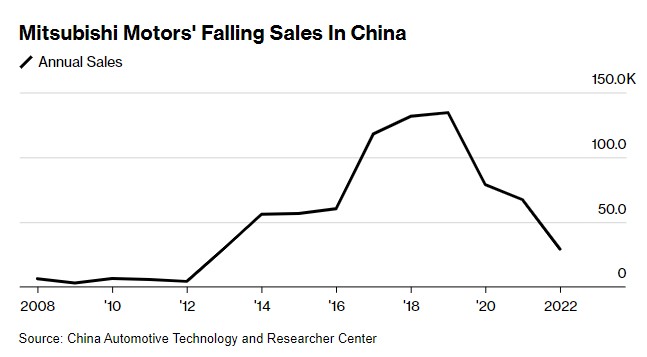

After peaking at over 134K in 2019, Mitsubishi’s sales have fallen significantly, with only 34.5K vehicles sold in 2022. The decline in sales correlates with China’s booming EV market, fueled by clean energy incentives and other government initiatives.

Nearly all Japanese automakers, including Honda, Mazda, and Nissan, are seeing sales fall in China due to a lack of electric vehicle models to compete with domestic automakers.

Sales of Chinese brands accounted for 53% of the market through the first half of the year as domestic EV makers like BYD, NIO, Li Auto, and XPeng continue to grab market share with unique models in essentially every segment.

City Dwellers’s Take

Although City Dwellers has been saying it for years, Japan’s reluctance to produce electric vehicles is already starting to cost them.

China is the world’s leading EV market as the industry continues to adopt electric cars at a record pace.

Last year, a Climate Group report warned Japan could risk a 14% drop in GDP if it failed to boost EV output, and it continues to look more and more apparent that’s the direction we are headed.

Japanese automakers are not the only ones feeling the heat. Volkswagen, which has been a leader in China, saw sales drop 3.6% last year and was surpassed by BYD in passenger car sales for the first half of the year.

In light of this, most automakers mentioned here have recently ramped up EV efforts, including investing in battery tech, dedicated EV platforms, and more efficient models.

Japan is increasing support to advance storage battery tech with over 330 billion yen ($2.3B) in subsidies. Toyota is set to receive nearly 120 billion yen ($847M) of it to fuel its recently revealed EV battery plans.

FTC: We use income earning auto affiliate links. More.