Tesla extends lead in California, nearly 1/4 of new vehicles have plugs

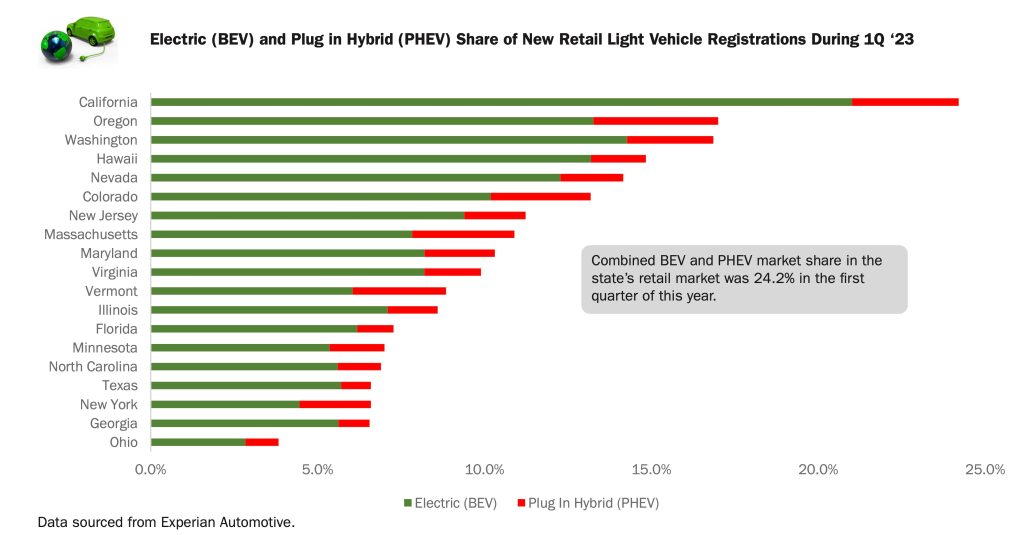

Tesla continues to have the two top-selling vehicles in California, with the Tesla Model Y extending its #1 sales lead over the competition and the Model 3 holding strong at #2. But other manufacturers’ sales are picking up too, leading the state to a 23.2% market share for vehicles with plugs – 19.5% BEV and 3.7% PHEV.

Each quarter, the California New Car Dealers’ Association releases data showing trends in auto sales. These trends have been interesting to watch from an EV perspective, given California’s status as the EV market share leader in the US.

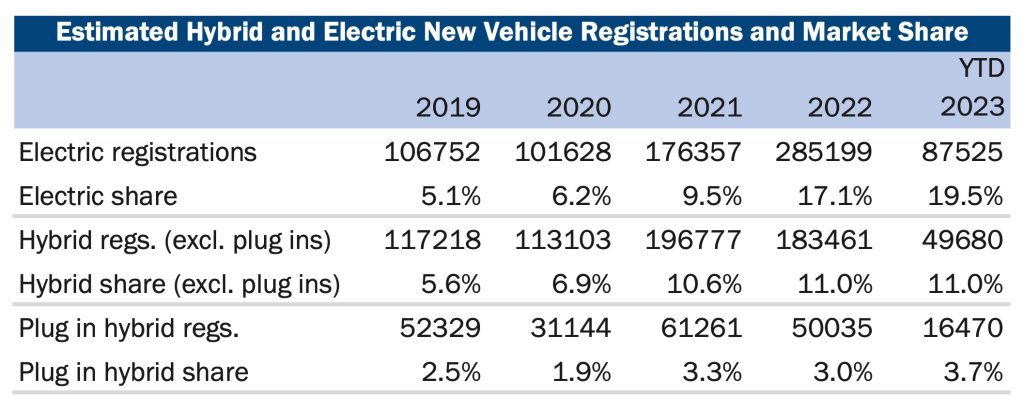

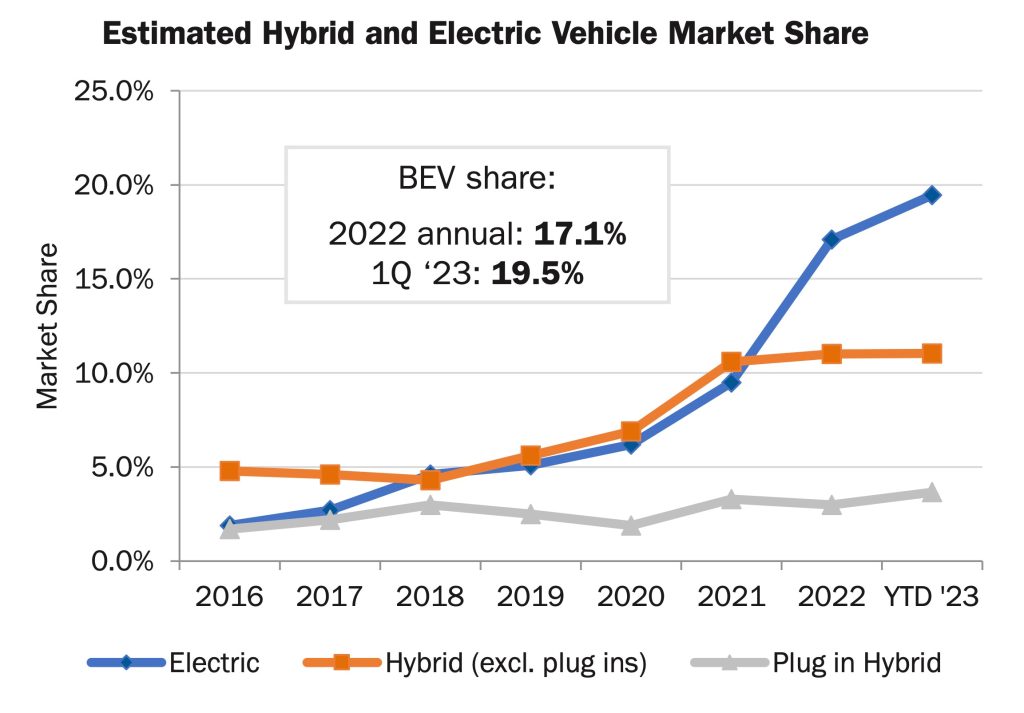

And that market share just continues to rise. In Q1, nearly a quarter of California’s cars had a plug on them, and more than a third of them had some sort of electric motor in them (hybrids were an additional 11%, making 34.2% “electrified” vehicles total).

Additionally, it is clear that California is choosing BEVs, rather than PHEVs and hybrids, as BEV sales growth continues to decouple from hybrids and PHEVs. PHEV and hybrid sales are mostly flat compared to last year, while BEVs continue to rise.

That said – BEV + PHEV share is actually flat compared to Q4 of 2022, which was about 24%.

Over the years, Tesla’s performance in California, the state where the company was founded and grew to become the behemoth it now is, has been strong and only getting stronger.

Last year, the Tesla Model 3 outsold the Toyota Camry in California, which had previously been the best-selling car in the state for 28 years straight. This was particularly impressive given the price of the Model 3 last year, which was significantly higher before this year’s massive price drops.

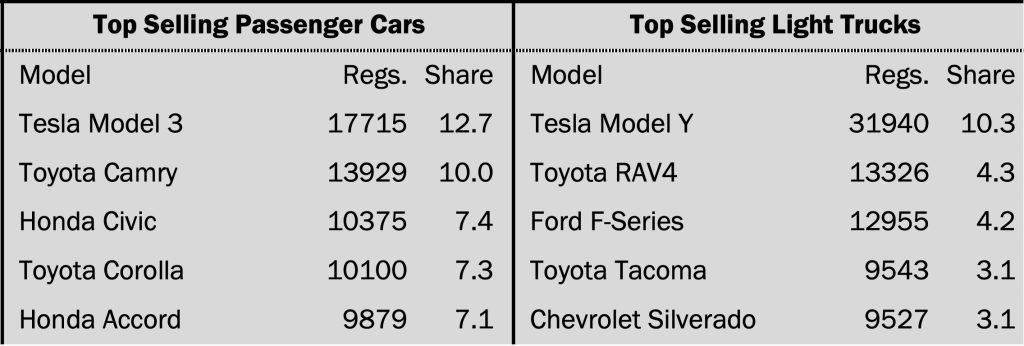

The newest data shows Tesla continuing its dominance, with the top-selling passenger car and top-selling light truck in the state. The Tesla Model Y is the state’s most popular vehicle, selling 31,940 units in the first quarter, trailed by the Model 3 with 17,715 units.

Just behind Tesla’s two vehicles are the Toyota Camry and RAV4 and the Ford F-Series. These are interesting because all three of them are powerhouses – the F-series has been America’s best-selling vehicle for decades, the RAV4 has been America and the world’s best-selling SUV for some time, and the Camry had been California’s best selling car for decades as well.

And the Model Y expanded its dominance significantly. Last year, it held 7.6% of the light truck market, selling 1.4x as many vehicles as the second-place RAV4. This year so far, Model Y has 10.3% of the popular light truck segment, and sold a whopping 2.4x as many units as second-place RAV4.

Things are getting a little closer in passenger cars, with the Camry holding fairly steady at 10.0% (compared to last year’s 10.7%) and Model 3 dropping slightly to 12.7% (from last year’s 15%). So the Model 3 has held its position, but its getting a little closer than it was. This could be due to the upcoming Model 3 “Project Highland” refresh.

Combined, Tesla is still the #2 selling brand, behind Toyota, since Tesla sells in fewer segments than Toyota does. But Toyota’s full-year market share was 17.3% in 2022, and it has dropped to 15.2% in Q1 2023. Tesla’s was 11.2% in 2022, and has seen a small increase to 11.8% in 2023 so far. If this pace continues (and Toyota continues not to make EVs), we could see Tesla overtake Toyota as the top-selling company in the next year or two.

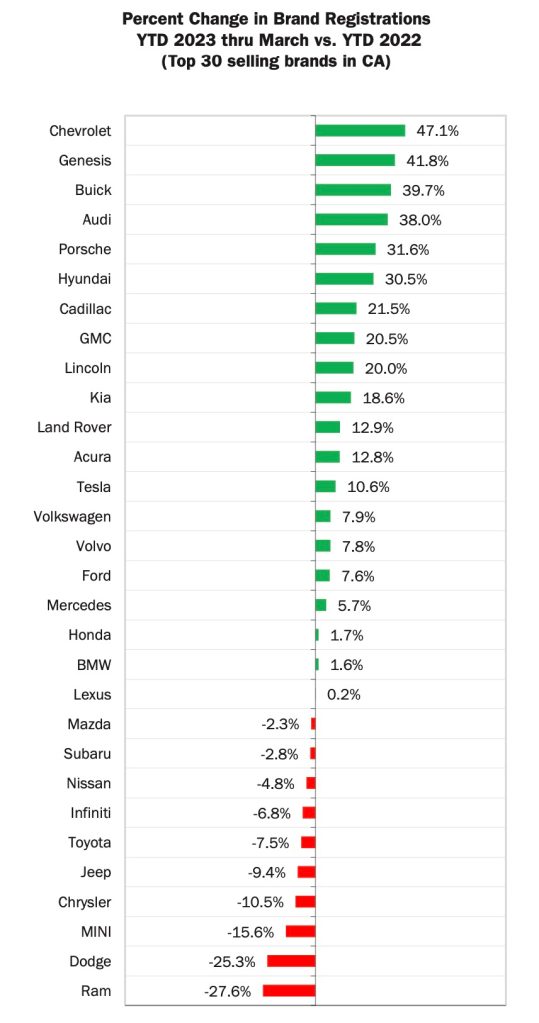

Last year, we also saw that virtually every brand had decreasing sales, with the only notable exceptions being Tesla (up 54%) and Genesis (up 26%), mostly due to a global downturn in the auto industry related to pandemic supply challenges. But compared to the first quarter of last year, the first quarter of 2023 has seen sales increases for most brands – with Tesla actually around the middle of the pack, with a sales increase of just 10.6%.

City Dwellers’s Take

The reason this data is interesting is because California isn’t so much an outlier in EV sales as it is a leader. The state tends to adopt and set trends ahead of other states, and can be seen as a bellwether for where the rest of the country will end up going eventually. Lots of style and technology trends start in California and then filter out elsewhere, and EVs have shown to be one of them.

EV market growth is nothing new to readers of City Dwellers, so it’s not like this new data is revolutionary or anything, but it can help us keep an eye on trends of where the market is going.

That said, while EV market share is growing compared to last year, it’s interesting to note that they’re not really increasing compared to last quarter. This could be due to the famous Tesla end-of-year sales pushes, which tend to backload EV sales. Or it could be because supply challenges affected the whole industry last year, depressing sales overall, whereas Tesla was comparatively less affected by those challenges and were able to buoy EV sales with their relatively unaffected production schedule.

Or it could have to do with the increasing chaos surrounding Tesla CEO Elon Musk. Anecdotally, as a Californian who knows a lot of young people interested in buying electric cars, a lot of people are getting turned off of the brand due to his recent behavior.

But also, Q1 didn’t really capture the full extent of Tesla’s price drops, which were intended to spur demand which has been an issue for Tesla lately. So perhaps we’ll see some more growth in Q2, as we still expect California to exit this year with a good ~25% or so EV market share, if trends continue.

FTC: We use income earning auto affiliate links. More.