Rivian CEO sees ‘very clear’ set of steps to profitability

As EV deliveries pick up, Rivian’s (RIVN) CEO RJ Scaringe says the company is seeing significant progress in lowering costs. As losses improve, Rivian’s leader explained, “We will see a very clear” set of steps toward profitability.

Scaringe made the comments Tuesday morning in an interview with CNBC’s “Squawk Box,” explaining the EV maker’s production ramp and improving financials.

The interview comes a day after Rivian beat expectations, delivering 15,564 electric vehicles in Q3. Rivian’s Q3 deliveries improved 24% from last quarter’s total of 12,640.

Rivian also produced 16,304 EVs during the quarter, up 17% from 13,992 in Q2. As the startup better leverages its Normal, Illinois facility, Rivian believes it can make a profit on each vehicle made by the end of next year.

Although the company’s growing deliveries are getting all the attention, many want to know when Rivian will turn a profit.

Rivian’s average transaction price is over $80,000 per vehicle, yet the company is still losing money on each car built.

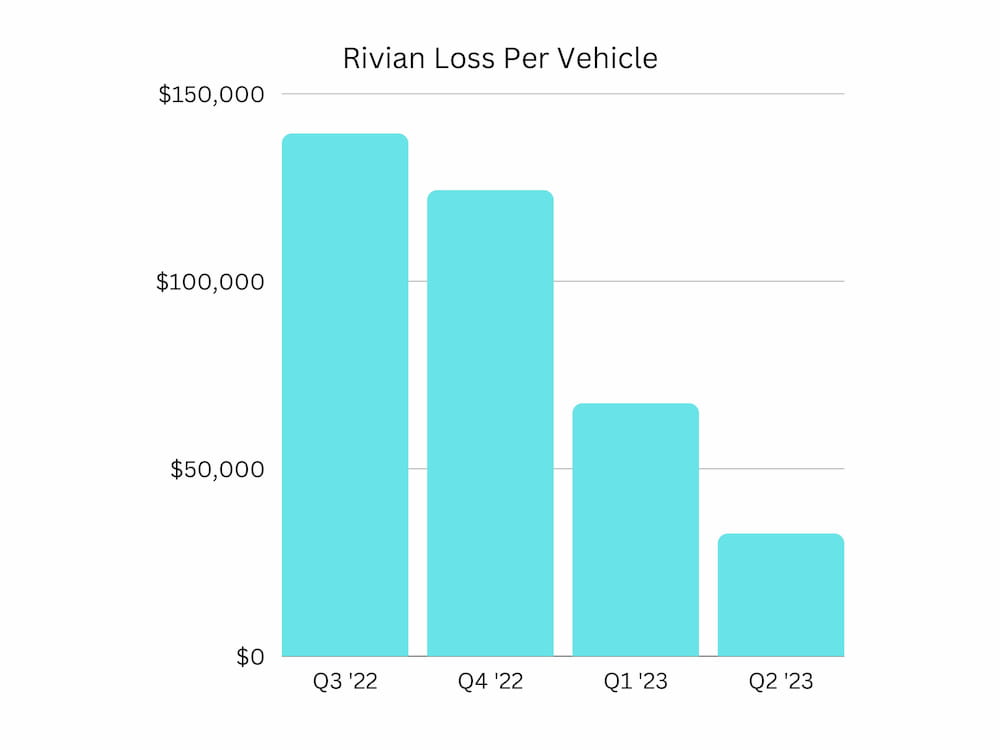

Many reports have been quick to point out that Rivian lost $32,595 on each vehicle it made in Q2, but this is still a 50% improvement from Q1’s loss per vehicle of $67,329.

Is Rivian on the road to profitability?

Scaringe has previously said he sees Rivian reaching a break-even point on each EV built by the end of next year. Reaffirming these comments, Scaringe told CNBC the company is seeing significant progress quarter over quarter.

He added, “What we’re going to see is a very clear staircase or set of steps that get us to profitability as a business.”

Rivian’s production ramp is the foundational piece to achieving profitability. After beating Q3 expectations, Rivian confirmed it’s on track to reach its 52,000 annual production guidance.

The introduction of its in-house Enduro drive units and LFP battery packs have been a key enabler of the recent production ramp.

Rivian ended the second quarter with around $9.2 billion in cash and equivalents, which will help fund its production ramp. When asked if the company will need to raise funds before introducing its next-gen R2 products, Scaringe said Rivian is focused on efficiently deploying capital and is “very comfortable with the fact that we’ve maintained a strong balance sheet.”

Scaringe reiterated that he does not see customer overlap with Tesla’s Cybertruck and the Rivian R1T. Instead, “it’s really important to have choice, to have selection, to have variety,” as Scaringe explained.

City Dwellers’s Take

With production and deliveries improving again quarter over quarter, Rivian will likely see another gross margin improvement.

Another 50% improvement would be impressive, suggesting an around $16,300 loss per vehicle. However, production and deliveries also grew 50% and 60%, respectively, in Q2.

In the third quarter, Rivian production and deliveries advanced 17% and 24%. Meanwhile, the company is leveraging fixed costs, improving efficiency with in-house components, and working to reduce operation costs.

We’ll learn more about Rivian’s financial situation and when we can expect the EV maker to reach turn profitable on November 7, when Rivian releases its Q3 earnings report.

FTC: We use income earning auto affiliate links. More.