Ford and GM EV strategies solid, but Tesla will stay top seller

Tesla may be on a downward trajectory in its share of the U.S. EV market. But even by the time the 2027 model year rolls around, the U.S. maker of exclusively EVs will stay on top.

That said, the strategies of Ford and GM “both appear relatively solid,” despite being very different from each other; and GM and Stellantis particularly, with its “evolving” EV strategy, are poised to make great gains in their share of the EV market by then.

These are among the remarks and conclusions from the annual Car Wars study, out last week from Bank of America, that assesses the relative strength of each automaker’s U.S. vehicle product pipeline.

The study, first run in 1991, looks to a range of primary and secondary sources ranging from industry contacts and trade publications to the supply chain and automakers’ strategies on vehicle platforms and planning around product cycles. This year’s study looks ahead to model years 2024 through 2027, which generally covers calendar years 2023-2026.

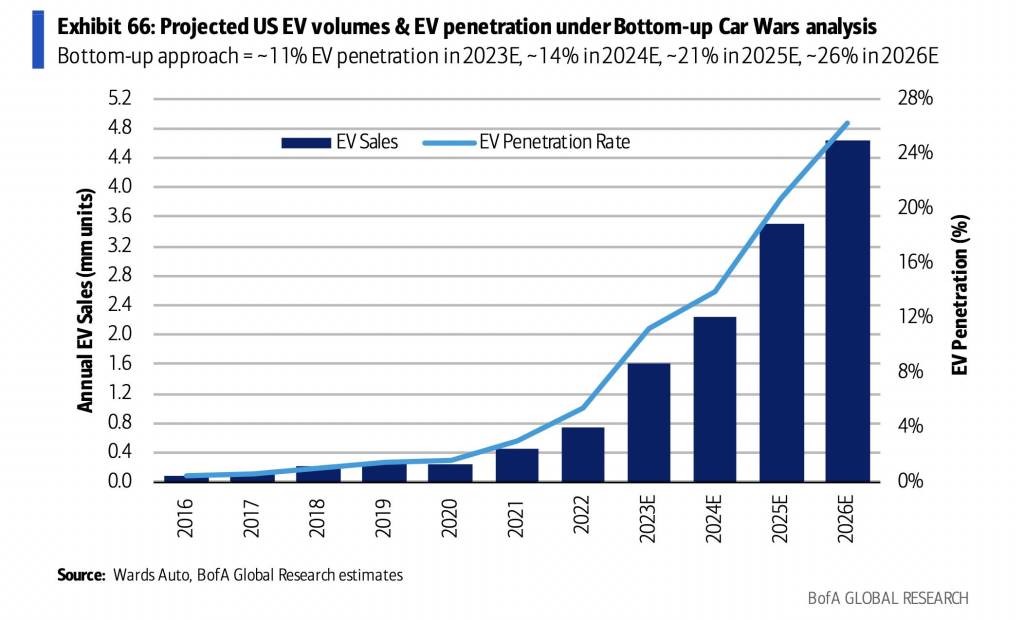

Bank of America Car Wars study 2023 – EV sales growth

BoA predicts EV sales to hit 11% of the total market this year, 14% in calendar year 2024, 21% in 2025, and 26% in 2026. Tesla had 78% of the EV market in 2018 and 62% of it in 2022, and BoA predicts that share will continue to drop to about 18% of it in 2026—as Tesla continues to rise to nearly 5% of total U.S. auto sales by then.

What BoA terms to be “EV entrants,” including Tesla plus others like Lucid, Fisker, and Rivian, will make up 7.5% of U.S. auto sales by then, with their combined share of the EV market dropping to about 30%. During the same time, so-called incumbent automakers will rise from barely adding up to more than 20% of the market to more than half of it by 2026—but no one of them in particular will exceed Tesla. It sees Stellantis as one of the biggest gainers in this, going from less than 1% in 2022 to 8% by 2026.

Today, the top-selling brand for EVs is Tesla and the top-selling fully electric model is the Tesla Model Y. Nothing else comes close. But within a few years that’s likely to change.

2023 Tesla Model Y – Courtesy of Tesla, Inc.

By new model nameplates (not necessarily sales volume), BoA expects GM to skew the most toward EVs, with them making up two-thirds of the company’s new-model introductions for 2024-2027. For the same period, EVs will make up just 22% of new-model introductions for Toyota and 24% for Nissan. Both of those latter automakers are expected to boast the most hybrid model introductions in that period.

BoA notes that just over the forecast period, the number of fully electric new-model nameplates will exceed that for ICE vehicles. It suggests that “ICE’s dominance is over, and hybrids will be “shrinking in relevancy as ICE vehicles and EVs approach cost parity.”

“GM’s product pipeline of electric vehicles appears particularly compelling, with 22 EV models launching over our forecast period, beginning with Cadillac and expanding across all the company’s brands,” it noted.

2024 Cadillac Lyriq

EVs aren’t the only portion of the market growing rapidly. The crossover utility market is saturated, and BoA suggested that even more new-model launches will create an environment for more price competition in model years 2025-2027. The total number of models on the market will also soar—to 416 models, up from 284 in 2022.

“In large part, this is driven by OEMs’ efforts to capitalize on a burgeoning recovery in the U.S. automotive cycle with fresh product, as well as to expand their EV and luxury lineups,” said the company.

BofA also points out that product cancellations are increasingly likely, so don’t entirely plan on automakers creating every EV or crossover they’ve suggested might be on the way.

“The next four+ years could be some of the most uncertain and volatile for product strategy ever,” it summed—with an outcome that likely once again depends somewhat on the next Presidential election.